Timing & frequency

Our pension annuity can be tailored to pay your client their retirement income monthly, quarterly, every six months or even annually. This can then be received either in advance or at the end of the chosen frequency period (in arrears).

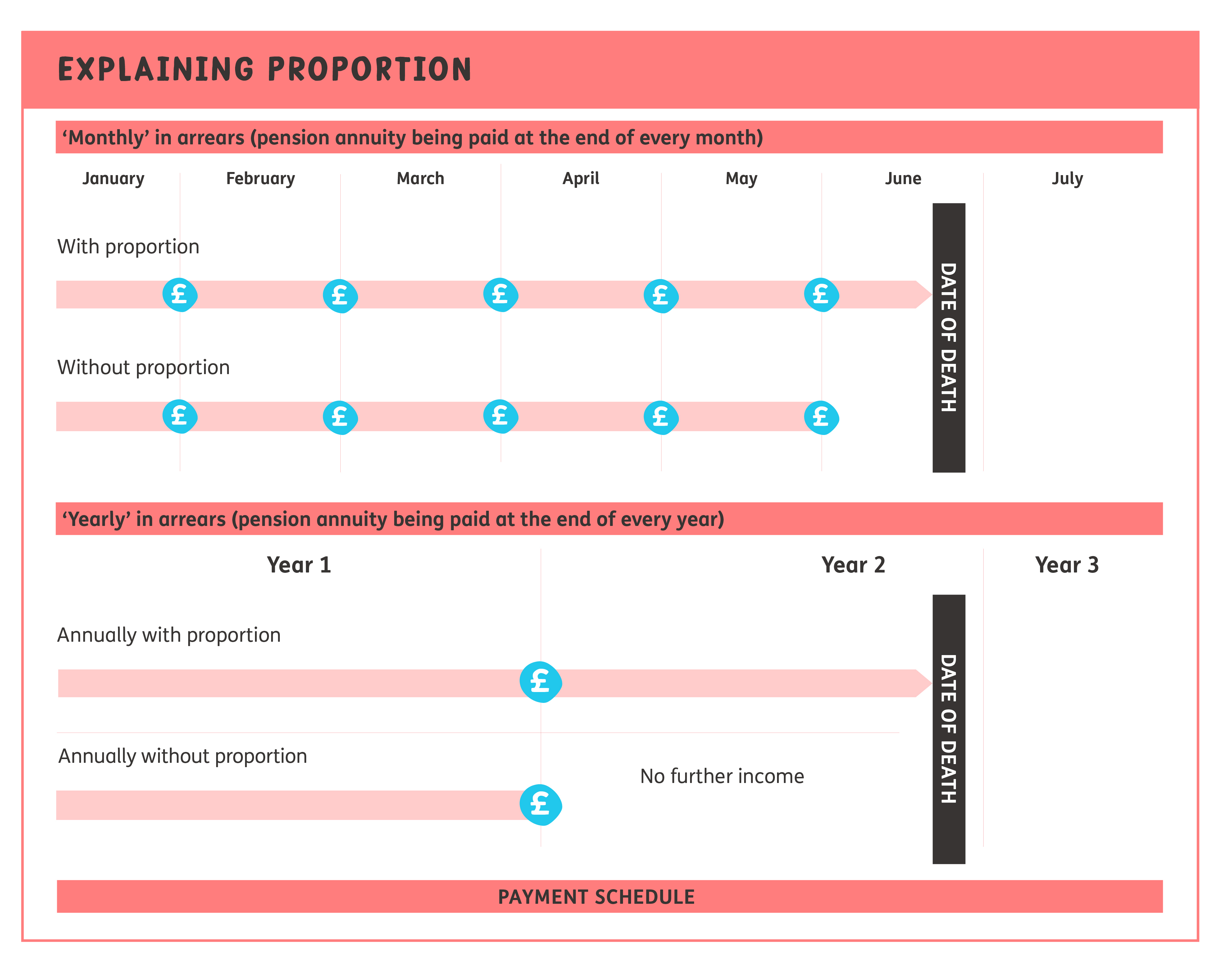

The diagram below illustrates how this works: Please consider

Please consider

- For the vast majority of people, the income they receive through pension annuity will replace a regular monthly wage or salary.

- The regular payment can be made either upfront (in advance) or at the end of the chosen payment frequency (in arrears).

- Choosing the frequency of payment will depend on your client’s individual circumstances, how easy budgeting between payments is, and the impact it has on their retirement income.

- Payments will stop when they die, unless options to protect their solution or to guarantee future payments are chosen at the time of the original purchase.

Proportion

If your client chooses to be paid in arrears, there is a further option to make a final payment on their death to their nominated beneficiaries.

This is known as 'proportion' and the payment covers the period between the last payment date and the date of death of the client. The diagram to below helps to explain how this feature works: Please consider that if income is paid less frequently (i.e. annually) and in arrears, the final payment due on death could be more substantial.

Please consider that if income is paid less frequently (i.e. annually) and in arrears, the final payment due on death could be more substantial.

To find out more about our GIfL solution then please view our dedicated landing page >

Alternatively, you can contact our Customer Support team - you can call them on 0345 302 2287 or email support@wearejust.co.uk.