Providing for dependants

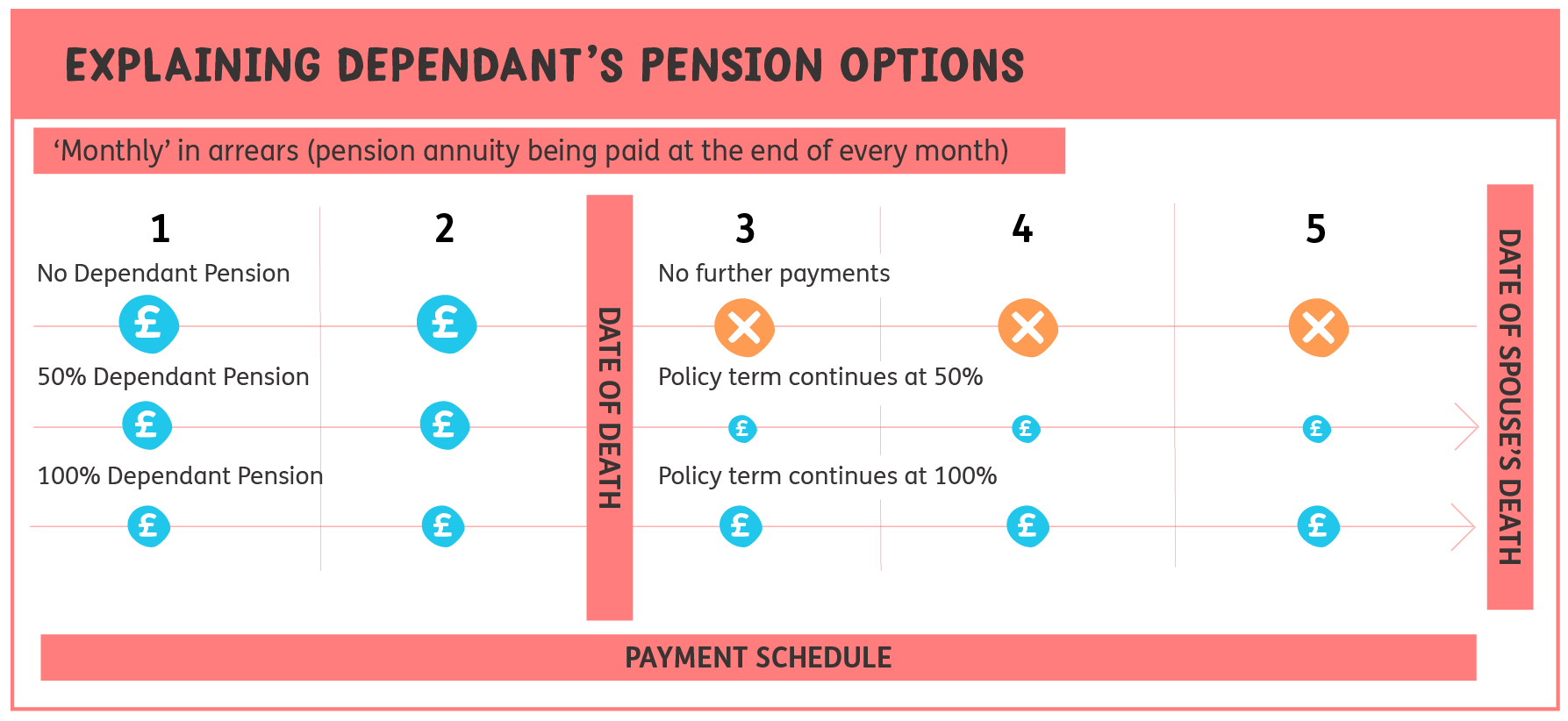

Choosing to include a dependant's pension as part of their GIfL solution allows a percentage of the income the client has been receiving to transfer to a dependant (for example, a spouse or civil partner) on their death. Your client can choose the percentage of their income to be covered in this way, for example 50%, 100% or another percentage, depending on their financial needs and circumstances.

The diagram below explains how the option works across different levels of cover.

Points to consider

- When your client dies, the selected percentage of the income they've been receiving switches to pay their nominated dependant. It continues to pay them an income in the same way, for the rest of their life.

- Your client can provide the medical details of their dependant so that they can be factored into an underwritten quote.

- It is worth considering this option in conjunction with any other provisions that may already be in place such as other pensions, savings or life assurance policies.

- Where an individual dies before age 75 with a joint life annuity, any payments to their dependants will be tax-free. If they die after the age of 75, the income will be taxed at the dependant's marginal rate of tax*.

*References to taxation are dependent on individual circumstances and subject to change.